Should you start your own ‘Monopoly Project’? Should you start acquiring rental properties? In this series we examine ways to start your own “Monopoly Project”.

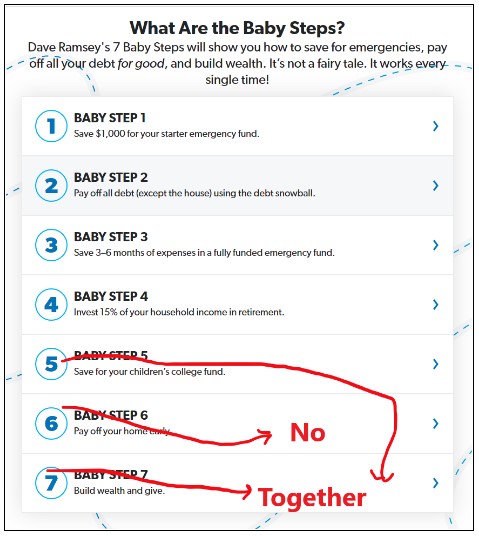

In our first post of this series, we explained by the first thing you should do is to get into shape – Financial Shape. We used Dave Ramsey’s “Seven Baby Steps” as a guide to getting into decent financial shape.

But we disagreed with Dave’s steps 5, 6, 7.

We disagree with steps 5, 6, 7 because of the serial nature of the three steps. It takes too long, and it is INEFFICIENT. By combining the three steps you can significantly decrease the amount of time needed for achieving success and make the process more efficient. We executed our “Monopoly Project” by combining steps 5, 6, 7. By the way, if you don’t have children or they’re already grown, you can substitute ‘early retirement’ (FIRE)for step 5. Building wealth through a monopoly project (for college or ‘early’ retirement) satisfies step 5, does not require step 6, and accomplishes step 7.

In fact, step 5 (“Save For Your Children’s College Fund”), was our motivation for starting our Monopoly Project as explained in “Our Story – Part 2: We Buy Two More SFHs”.

So, how did we combine steps 5, 6, 7?

We did NOT do step 6 “Pay Off Your Home Early”. We saved enough money for a down payment for a SFH for investment/rental purposes.We started by buying a SFH for $135,000 with 10% down ($13,500) in 1999. Note that we did not have an elaborate plan. We did not have “a team of advisors” like every blog and paid real estate training course says you have to have. I’ll talk more about the “OPM guys” (Other People’s Money) crowd in next installment. We did follow the Biblical advice from Proverbs:

Proverbs 16:3 (ESV) Commit your work to the Lord, and your plans will be established.

Our plan was to buy one house and continue purchases to accomplish steps 5 and 7 without paying off our personal house first as recommended in step 6. We did “sit down and count the cost” as recommended in Luke 14:28-30:

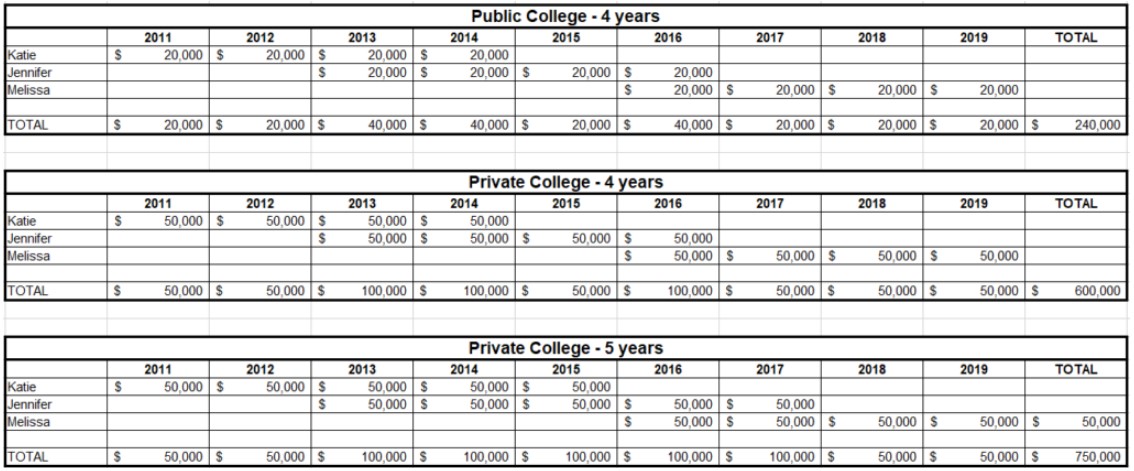

We estimated the most and least cost for three college educations as explained previously:

In the late 1990s we had three young daughters and were concerned about college costs. Here was our best and worst case calculation for college costs:

Anywhere from $240,000 to $750,00 coming due starting in 10 years!

So, method number 1 to start your own monopoly project, if you own your own home, is to save up and buy another house. You can move into the new house and rent out the old one. This the ‘moving on up’ strategy of buying a nicer or larger house (as your family grows) and renting out the previous one. An added benefit is that the new house qualifies for owner occupied financing which qualifies for lower rate, less down payment and better terms and conditions than investor financing.

Or simply rent out the new one. Note that you can’t legally get preferential owner-occupied financing (typically 1% to 1.5% lower interest rate) for the new one if it is for rental purposes. We did this electing to pay the premium for a rental property.

We will look at some other methods to to your own ‘monopoly project’ next. There is no one single, true path.