Swimming Pools and Movie Stars

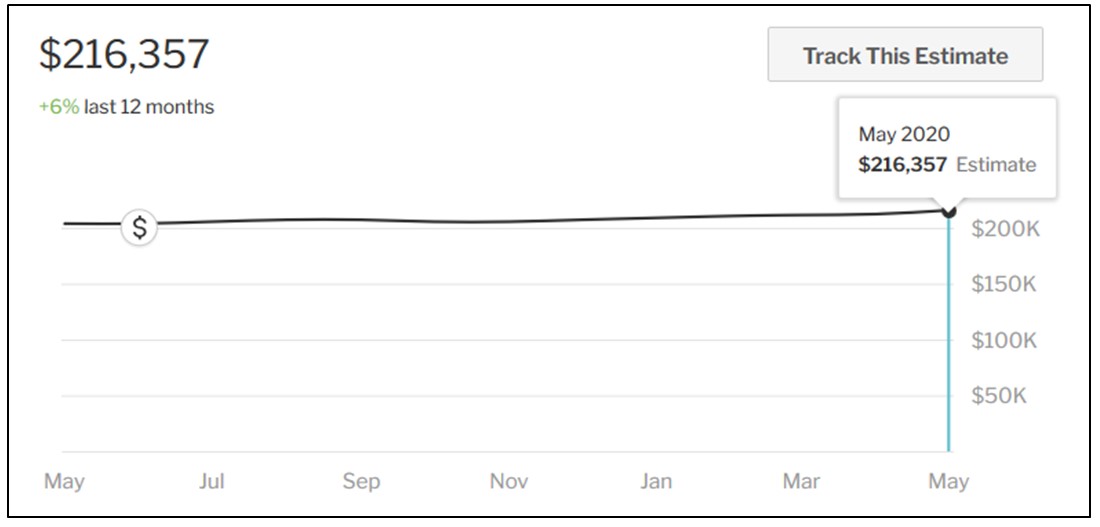

Does a swimming pool add to the value of a rental house? Our Realtor Jeff Sutherlin of EXP Realty had a listing over the weekend that includes a pool (sold in one day, call Jeff if you need a Realtor in Phoenix, Arizona). Is a pool a net positive in [...]